|

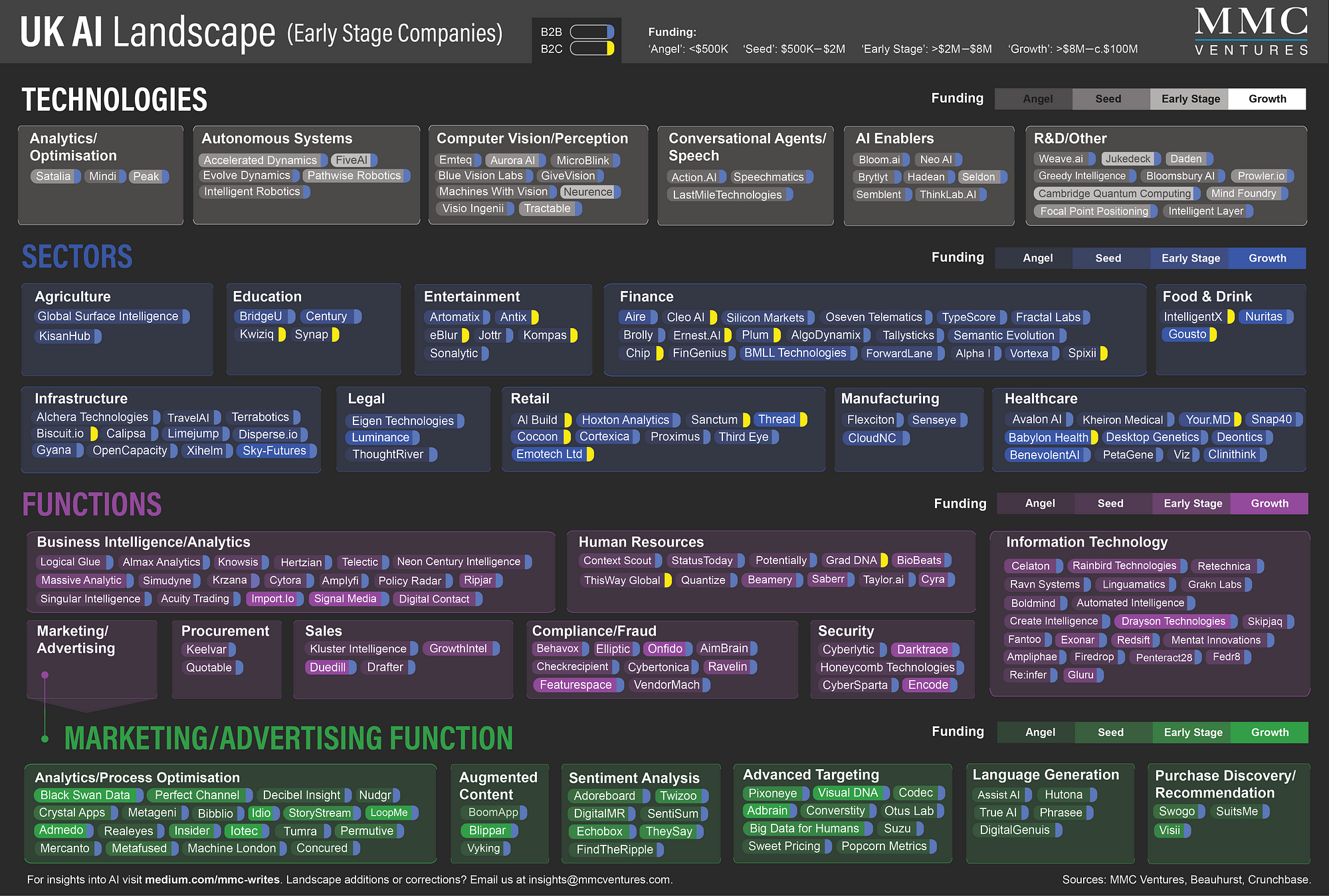

| Figure 1 (above): The landscape of early stage UK AI companies. |

With every paradigm shift in technology, waves of innovation follow as companies improve and then reimagine processes. Today we are in the early stages of the global artificial intelligence (AI) revolution. Machine learning algorithms, whose results improve with experience, enable us to find patterns in large data sets and make predictions more effectively — about people, equipment, systems and processes. (For an accessible introduction to AI, read our Primer.) But what are the dynamics of AI entrepreneurship in the UK?

We’ve mapped 226 independent, early stage AI software companies based in the UK and met with over 40 of these companies in recent weeks. Below, we share six powerful dynamics we see that are shaping the UK AI market— from changing activity levels and areas of focus, to trends in monetisation and the size and staging of investment.

Interested in more venture capital insights? Sign up for our blog posts.

AI entrepreneur? Get in touch.

The UK AI landscape: 226 companies and counting

Over time, we expect the distinction between ‘AI’ companies and other software providers to blur and then disappear, as machine learning is employed to tackle a wide variety of business processes and sectors. Today, however, it is possible to point to a sub-set of early stage software companies defined by their focus on AI.

We’ve researched 226 early stage AI companies in the UK and met with 40 of them. We’ve developed a map (Figure 1, above) to place the 226 according to their:

- Purpose: Is the company focused on improving a business function (for example, marketing or human resources) or a sector (healthcare, education, agriculture)? Or does the company develop an AI technology with cross-domain application?

- Customer Type: Does the company predominantly sell to other businesses (‘B2B’) or to consumers (‘B2C’)?

- Funding: How much funding has the company received to date? We bracket this from ‘angel’ investment (under $500,000) through to ‘growth’ capital ($8m to ~$100m).

We’ll update our map regularly. We apologise if we’ve omitted or mis-classified your company; we’re aware that many early stage companies may be using, but not presenting, extensive AI. Please get in touch with additions or corrections.

After analysing the market and meeting with 40 companies in recent weeks, we highlight the following six dynamics in the market:

1. A focus on AI for business functions

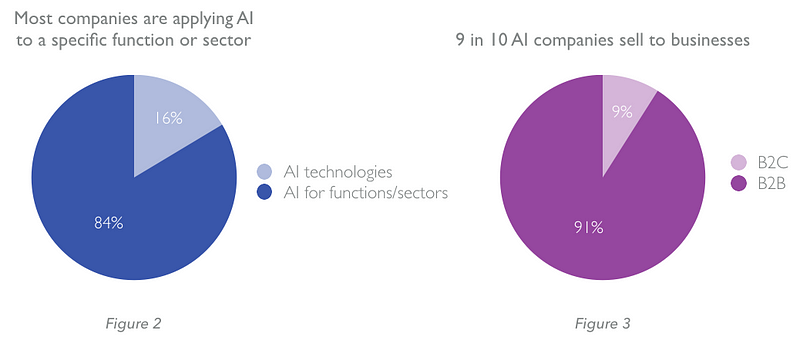

Most early stage UK AI companies — five in every six — are applying machine learning to challenges in specific business functions or sectors (Figure 2, below). Reflecting the nascent stage of the field, however, one in six is developing an AI technology — a capability, platform or set of algorithms — applicable across multiple domains. These companies’ activities range from the development of computer vision solutions to the creation of algorithms for autonomous decision-making.

To whom are AI companies selling? Nine out of 10 AI companies are predominantly ‘B2B’, developing and selling solutions to other businesses (Figure 3, below). Just one in 10 sells directly to consumers (‘B2C’).

|

| Add caption |

A ‘cold start’ challenge around data is inhibiting the number of new B2C AI companies. Training machine learning algorithms usually requires large volumes of data. While B2B companies can analyse the varied and extensive data sets of the businesses they serve, in the absence of public or permissioned (e.g. Facebook profile) data, customer-facing companies usually begin without large volumes of consumer data to analyse. Typically, therefore, they deploy machine learning over time as their user bases and data sets grow. Gousto, for example, is an MMC portfolio company that delivers recipes and associated ingredients to consumers for them to cook at home. Today, Gousto’s team of machine learning PhDs, data analysts and engineers leverage AI for warehouse automation and menu design. Since its inception Gousto has had a vision for the use of AI, but the Company has achieved its vision over time.

Given the ‘cold start’ challenge, the reality is that most consumers will first experience machine learning via the world’s most popular consumer applications — Facebook, Google, Amazon, Netflix, Pinterest and others — that leverage vast data sets and machine learning teams to deliver facial recognition, search and entertainment recommendations, translation capabilities and more.

2. AI entrepreneurship is unevenly spread

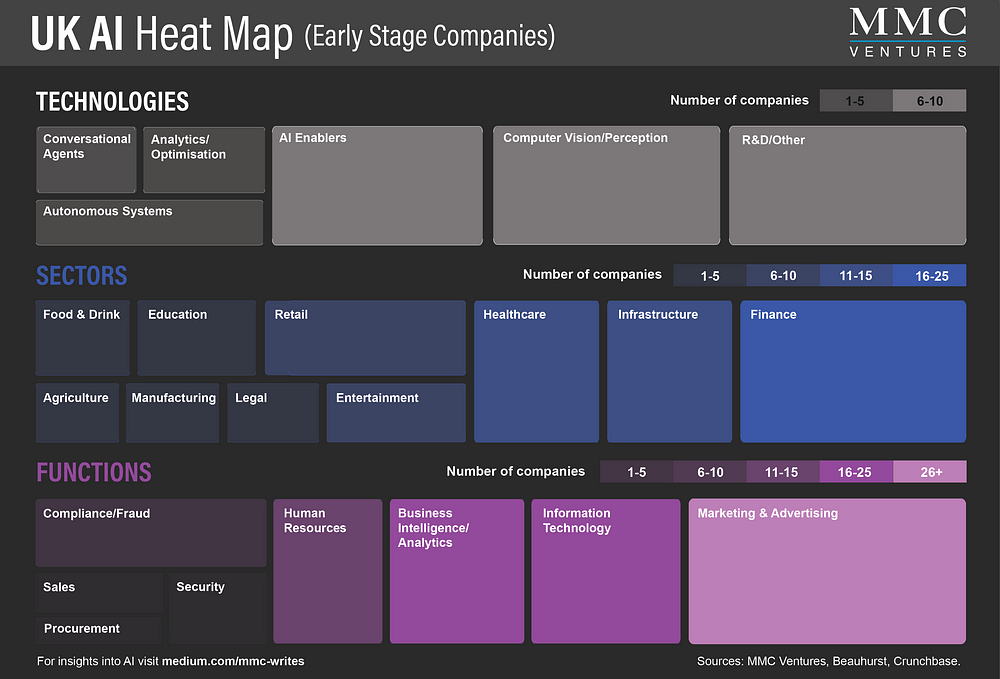

A heat map highlights areas of early stage activity, as measured by the number of companies in each segment (Figure 4, below).

|

| Figure 4: A heat map of early stage AI companies in the UK |

Activity is greatest within:

- The Marketing & Advertising,

- Information Technology, and

- Business Intelligence & Analytics functions; and

- The Finance sector.

- The Human Resources function; and

- The Infrastructure,

- Healthcare and

- Retail sectors.

The sectors above are well suited to the application of AI, explaining the concentration of AI activity within them. The opportunity for value creation within each segment is demonstrable as well as significant. In marketing and in finance, for example, improvements in campaign conversion and financial performance against a benchmark are readily quantifiable. All offer numerous prediction and optimisation challenges well suited to the application of machine learning. All offer large data sets for training and deployment. A path to better-than-human performance is technically achievable. The alternatives are impractical or expensive. And all are specialised verticals, distant from the competitive threat posed by the consumer- and horizontal focus of the AI platform providers Google, Amazon, Microsoft and IBM — with the exception of healthcare where Google and IBM both enable and challenge.

As attractive market fundamentals catalyse activity, the strongest AI companies can develop a competitive moat by:

- bringing deep domain expertise to bear in a complex domain;

- developing proprietary algorithms;

- creating a network effect around data by leveraging non-public data sets; and

- by securing adequate capital to build a high quality machine learning team and go-to-market resources.

Activity in Marketing & Advertising dominates; one in five early stage UK AI companies target this function. The fundamentals of modern marketing and advertising represent a sweet-spot for AI. Consumers have billions of touch points with websites and apps, providing a rich seam of available, but complex, data. Further, almost every stage of the marketing and advertising value chain is ripe for optimisation and automation — including

- content processing,

- consumer segmentation,

- consumer targeting,

- programmatic advertising optimisation,

- purchase discovery for consumers and

- analysis of consumer sentiment.

Areas of lower activity

In a number of areas, activity appears modest relative to market opportunities. In the Manufacturing sector, for example, there are few startups to address a substantial need.

- Machine learning has the potential to unlock 20% more production capacity through predictive, optimised maintenance of machines.

- Raw material costs and re-working can be reduced through improved analysis of product quality data.

- Further, ‘buffering’ — storing raw materials and part-developed products to compensate for unforeseen inefficiencies during production — can be reduced by up to 30% given more predictable production capacity.

- The proliferation of sensors in the manufacturing industry, including sensor data from the production line, machine tool parameters and environmental data, has also increased significantly the data available for machine learning.

Within the Compliance & Fraud function, there appear few startups capitalising on banks’ ballooning expenditure on compliance.

- 30,000 people in Citi — 12% of the Bank’s workforce — now work in compliance. In its 1Q15 conference call, Citi highlighted that over 50% of the $3.4B it saved through efficiency initiatives was being consumed by additional investments in regulation and compliance. The dynamics are similar among Citi’s peers.

- JP Morgan increased compliance spend 50% between 2011 and 2015, to $9B, while

- Goldman Sachs highlighted that its 11% increase in headcount in the last four years has largely been to meet regulatory compliance needs.

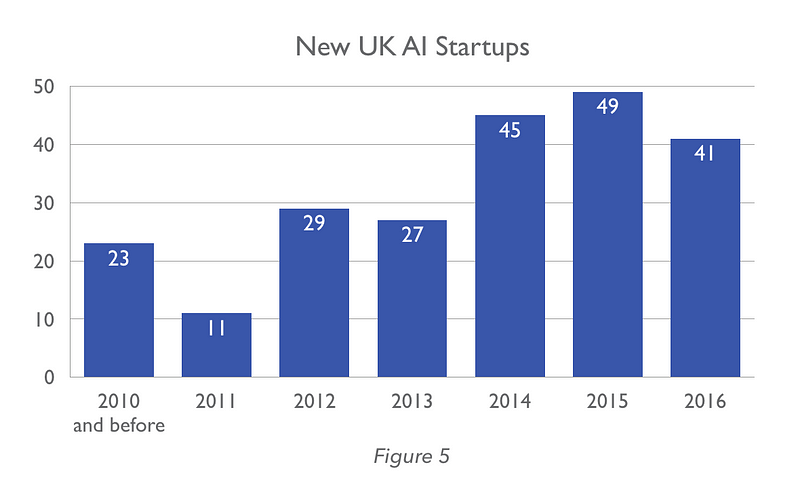

3. AI entrepreneurship has doubled

The number of AI companies founded annually in the UK (Figure 5, below) has doubled in recent years (2014–2016) compared with the prior period (2011–2013). Over 60% of all UK AI companies were founded in the last 36 months. During this period, a new AI company has been founded in the UK on almost a weekly basis.

Entrepreneurship in AI is being fuelled by the broader coming of age of AI as well as factors specific to early stage entrepreneurship.

Entrepreneurship in AI is being fuelled by the broader coming of age of AI as well as factors specific to early stage entrepreneurship.

Regarding AI activity generally,

- seeds planted during the last 20 years of AI research are bearing fruit today.

- New algorithms, particularly convolutional and recurrent neural networks, are delivering more effective results.

- A logarithmic increase in the availability of training data has made it possible to tune machine learning algorithms to deliver accurate predictions.

- Development of graphical processing units (GPUs) has decreased the time required to train a neural network by 5x-10x. And

- a six-fold increase in public awareness of AI during the last five years has increased buyers’ interest in the technology.

Additional factors are fuelling an increase in new AI startups.

- Venture capital funding of AI companies has increased seven-fold in five years as investors see promise in the sector.

- The provision of AI infrastructure and services from industry cloud providers (Google, Amazon, Microsoft and IBM) is reducing the difficulty and cost of deploying machine learning solutions. And

- the growth of open source AI software — particularly TensorFlow, a library of components for machine learning — has reduced barriers to involvement.

Where are new AI companies focusing?

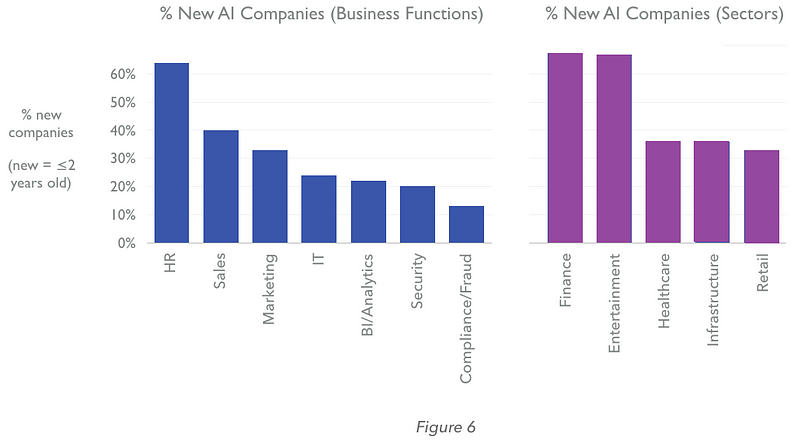

The HR business function and Finance sector have the highest proportion of new AI companies (Figure 6, below). Two thirds of AI HR and Finance companies are less than two years old.

The HR business function and Finance sector have the highest proportion of new AI companies (Figure 6, below). Two thirds of AI HR and Finance companies are less than two years old.

Recent activity in HR stems from a paradigm shift taking place within the function. HR is evolving from an administrative system of record to a predictive driver of growth and efficiency. Business owners are seeking to leverage previously under-utilised data sets to drive utility — ranging from competency-based recruitment to predictive modelling of employee churn.

It is unsurprising that in the business intelligence, security and compliance functions, and in the retail and infrastructure sectors, the proportion of new AI companies is lower. With large data sets ripe for machine learning, these sectors were the first to attract AI entrepreneurs.

4. A nascent sector relative to global peers

The UK AI sector is at a nascent stage in its development relative to global peers, presenting both opportunities and challenges.

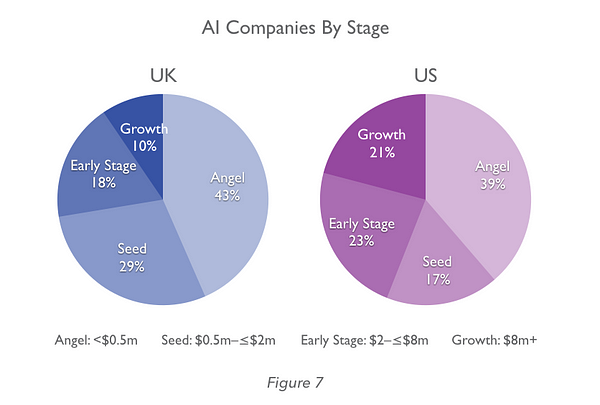

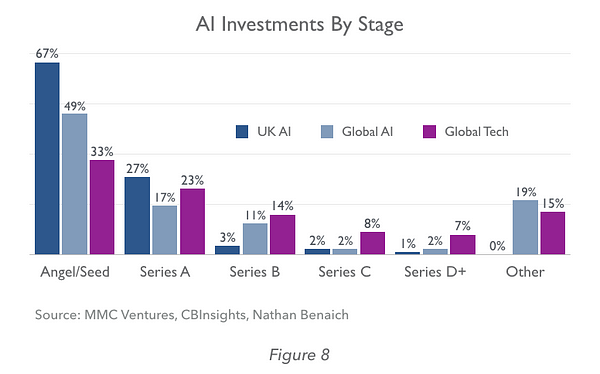

Today, three quarters of UK AI companies are at the earliest stages of their journey, with ‘seed’ or ‘angel’ funding, compared with half of US peers (Figure 7, below). At the other end of the spectrum, just one in 10 UK AI companies is in the late, ‘growth capital’ stage compared with one in five in the US. In 2015, the last full year for which data are available, almost all capital infusions into UK AI companies were at the angel, seed or Series A stage — while among global AI peers a third received later-stage funding (Figure 8, below).

This dynamic presents both opportunities and risks. A vibrant startup scene presents unrivalled opportunities for entrepreneurs, employees and investors in early stage companies. At the same time, more developed and richly funded overseas competitors may increase competitive pressures on UK companies. This effect may be exacerbated by the high proportion of AI companies that sell to enterprises, many of which source providers globally. The UK maintains valuable assets for AI research, including a quarter of the world’s top 25 universities and a growing ecosystem of AI executives and investors following the acquisitions of

5. The journey to monetisation can be longer

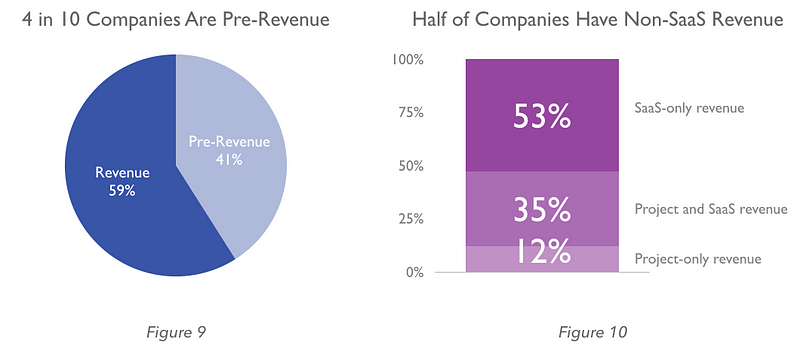

Over 40% of the AI companies we meet are yet to generate revenue (Figure 9, below). This is not an artefact of us meeting ‘early stage’ companies; the median profile of a company we meet is one

- founded 2–3 years ago that has

- raised £1.3m, has

- a team of nine and is

- spending £76,000 per month.

The idea that most AI companies — applied AI companies, at least — plan to be acquired pre-revenue instead of selling software and services is a myth. All the companies we met were implementing or developing monetisation plans. Why, then, are some AI companies taking longer to monetise or scale than is usual for early stage companies? We see four reasons:

- The bar to a minimum viable product (MVP) in this technically challenging field can be higher, requiring longer development periods. 90% of AI companies are B2B. The long sales cycles typical in B2B sales are exacerbated by many AI companies’ focus on sectors, such as finance, with sprawling and sensitive data sets.

- Deployment periods can be lengthy given

* extensive per-client data integration,

* data cleansing and

* customisation requirements.

Half the AI companies we meet have a pure software-as-a-service model; as many monetise significant client integration and customisation work in the form of project revenue (Figure 10, above). - The limited number of personnel available for implementation in early stage companies is inhibiting many AI companies’ growth. In a sentiment echoed by several companies, one told us “we couldn’t implement more sales even if we had them.” One third of many teams are engaged in deployment support.

- Exacerbated by cash burn rates increased by the high cost of machine learning talent, a longer path to monetisation can pose a challenge to AI companies.

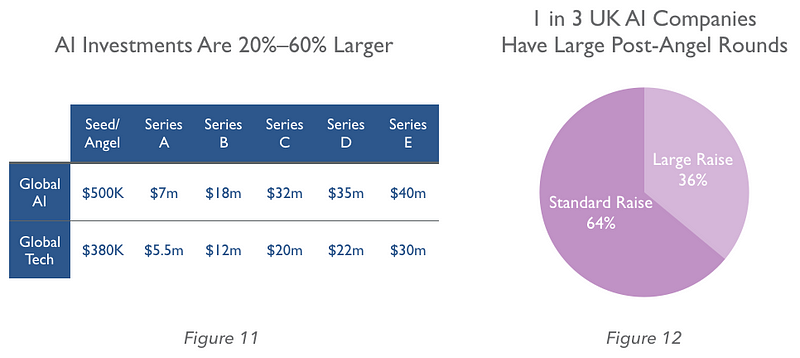

6. Investments are larger and staging is atypical

Globally at least, investments into AI firms are typically 20% to 60% larger than average capital infusions (Figure 11, below, shows 2015 data). This reflects company fundamentals and dynamics in the supply and demand of capital. AI companies’ capital requirements can be higher given

- longer development periods prior to product viability,

- the high cost of machine learning talent and

- the larger teams required for complex deployments.

- extensive supply (many venture capitalists seek opportunities to invest in artificial intelligence companies) and

- limited demand (there are relatively few AI companies in which to invest).

Further, in the UK a sizeable minority of companies jump from a seed rounds to a much larger raise than is typical for a subsequent round (Figure 12, below). 1 in 3 UK AI companies that raised more than $8m in a funding round raised less than $1m previously. As above, this dynamic is driven in part by AI companies’ capital requirements, but as much by the limited number of attractive investment opportunities in AI. Companies’ valuation expectations, meanwhile, are being supported by ‘acquihire’ offers for nascent teams.

Conclusion: An inflection point in UK AI

The last 36 months have marked an inflection point in early stage UK AI. Entrepreneurship has doubled, as AI technology comes of age and investment has increased. Yet, companies are early in their development relative to global peers, offering entrepreneurs and employees unprecedented opportunity and challenge. Three quarters of UK AI companies are at the earliest stages of their journey and activity remains uneven. Startups have concentrated on readily addressable business functions, where data sets are plentiful and optimisation challenges are pronounced. Today, business processes are being optimised. In the future, they will be re-imagined. Within the last 24 months, additional functions and sectors are starting to be tackled by AI entrepreneurs. The path to monetisation for today’s AI companies can be longer, but effective entrepreneurs are taking advantage of attractive capital dynamics to raise sufficient sums of money earlier in their journey.

As the AI revolution continues, the distinction between ‘AI companies’ and other software providers will further blur. Today, however, we are pleased to highlight the dynamics of a group of companies delivering remarkable benefits. Together, they are shaping the ‘fourth industrial revolution’.

ORIGINAL: Medium

By David Kelnar. Investment Director & Head of Research at MMC Ventures. 2x CEO/CFO. Love tech, venture capital, trends and triathlon. Dec 21, 2016

No hay comentarios:

Publicar un comentario

Nota: solo los miembros de este blog pueden publicar comentarios.